Check out the PDF of the article here: https://bit.ly/3DVg5kD

Follow us on Twitter to stay updated: @andrewpark_tja

Key Takeaways:

The economy is still at a decent stage. Relative to actual recessions, employment is at high levels, production/consumption is strong, aggressive declines in M2 Money Supply (excess liquidity) indicate lowering inflation, and the Fed has entertained the possibility of lowering its rate hike amounts following the FOMC meeting in November

However, the CPI measure of inflation remains high, rising interest rates have pushed mortgages to all-time highs and lowered housing activity, and we may be on the verge of a energy crisis

While the Fed is incentivized to quickly produce results for the public, by impatiently and improperly raising interest rates, solely with the focus of lowering CPI-measured inflation, the Fed could push a moderately-healthy economy into an unnecessary, forced-recession

The resignation of Liz Truss from the office of Prime Minister shows how it is unreasonable for leaders to promise growth by more borrowing money when there is no clear way to repay it. This is especially the case when central banks worldwide are implementing Quantitative Tightening, raising rates to combat record-high inflation

The selloff seen in American-listed Chinese equities after Xi Jingping secured his third term signal the negative outlook investors have towards China. We expect to see continuation of the economically-restrictive “Zero-Covid” policies he has set in place, and a gradual centralization of the Chinese economy

Economy Still Strong…For Now

Summary:

The economy is still at a decent stage. Relative to actual recessions, employment is at high levels, production/consumption is strong, aggressive declines in M2 Money Supply (excess liquidity) indicate lowering inflation, and the Fed has entertained the possibility of lowering its rate hike amounts following the FOMC meeting in November.

However, the CPI measure of inflation remains high, rising interest rates have pushed mortgages to all-time highs, crippling the housing market, and we may be on the verge of an energy crisis.

At this point, it is up to the Fed. If the Fed mistakenly chooses to push rates higher to combat perceived inflation, this could push us into an actual recession.

Full Story:

Positive news this week as Real GDP increased at a 2.6% annual rate in Q3 2022, beating the expected 2.4%, with growth largely attributable to net exports. This comes after the previous two quarters where we saw 1.6% (Q1) and 0.6% (Q2) declines, sending many into fears that we may have entered a recession.

Jeff Bezos recently made headlines for a tweet where he stated, “the probabilities in this economy tell you to batten down the hatches.” In addition, recession probability models by Bloomberg economists announced a 100% chance of recession within 12 months.

However, contrary to these statements, looking at recent economic data, the outcome of a recession may not be as concrete as you would expect.

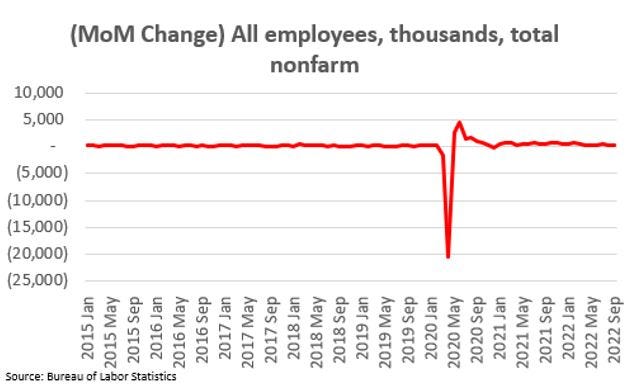

Employment: Total non-farm employment has continued its steady recovery since its bottom in March 2020. While employment growth has slowed as of the past 3 months, with the US adding only ~263K to employment in September (compared to the LTM average growth of ~474K) this slight decline is nowhere near the sharp fall-off we would expect to see with a full-on recession (Bureau of Labor Statistics):

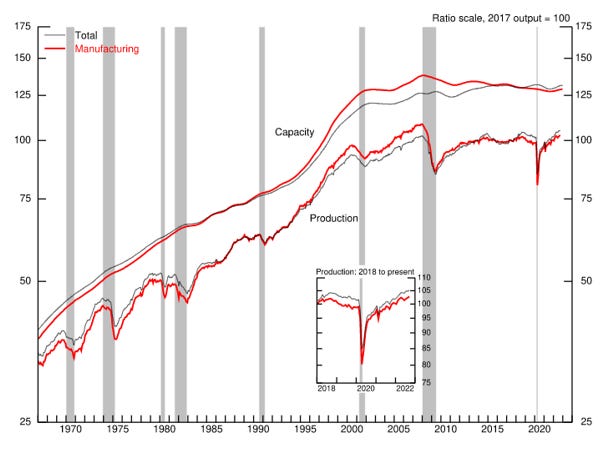

Production: While growth has slowed, results are largely positive and signal that we have yet to fall into a state of recession. Manufacturing output increased 0.4% in September, increasing at a 1.9% annual rate in the third quarter (comparted to 3.2% in the second quarter). (Federal Reserve):

Consumption: Consumer spending seems healthy as well, with personal consumption expenditures (PCE) increasing by $113B (0.6%) in September. Personal income rose by $79B (0.4%) with disposable personal income also up by $71B (0.4%).

As an interesting note, a trend we are now seeing is the return to pre-Covid habits, including physical retail shopping. E-commerce businesses, who overly invested in expanding workforce and production, are forced to scale back operations. In October, Amazon was forced to announce a hiring freeze in corporate retail until early-2023.

During the height of the pandemic, the boom in online shopping brought on by lockdowns and federal stimulus checks facilitated an unprecedented growth in online retail. This led many e-commerce businesses to believe that this would be the “new-normal” moving forward and to invest in expansion. This has not played out as expected as E-commerce sales as a percentage of retail have largely plateaued since mid-2020.

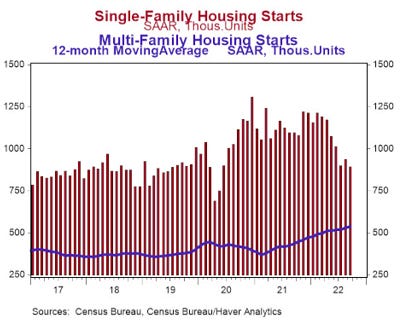

Housing: A large area of concern for the economy is the recent slowdown in the housing market.

Sellers are now citing how properties which would have sold in a matter of a week just a year prior are now sitting on the market for months as inventories climb and prices continue to fall.

This has been due to the aggressive tightening policy implemented by the Federal Reserve, driving up interest rates and the costs of building/financing home purchases. In October, the average rate for a 30-year fixed mortgage topped 7% for the first time since 2002 (Freddie Mac).

For many Americans, rising mortgage rates have made home purchases simply unaffordable. Assuming a 20% down payment, it is estimated the monthly mortgage payment in Los Angeles has increased over ~100% since mid-2021 (Bloomberg). As such, existing home sales have been in decline over the past eight months. In September, sales of Single-Family Homes were down 10.9%, with Housing Starts down by ~8% (Census Bureau).

The Fed Needs to Ease the Breaks

Summary:

The drastic decline in M2 Money Supply Growth is a strong signal of already-lowering inflation. In addition, studies have shown it takes significant time (2-4 years) for interest rate-hikes to trickle through the economy and show a significant impact on inflation. While the Fed is incentivized to quickly produce results for the public, by impatiently and improperly raising interest rates, solely with the focus of lowering CPI-measured inflation, the Fed could push a moderately-healthy economy into an unnecessary, forced-recession.

Full Story:

Persistent Inflation: While we have seen a halt in the rise of CPI, falling to 8.2% in September from its 9.1% peak in June, this is still a long way off from the ~2% long-term target goal.

This is despite the best efforts of the Fed throughout the past year raising the Federal Funds Rate by unprecedented amounts from 0.0 - 0.25% in January to its current level of 3.0 - 3.25% today, with another 75 bps rate hike expected in November.

Until signs of declining inflation are readily apparent, some members of the Fed have expressed their intention to maintain their hard-line stance. As stated by Philadelphia Fed President Patrick Harker, “Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year”.

We believe this to be a drastic mistake which could have dangerous consequences if implemented. The Fed is hyper-fixating on CPI and rate hikes, failing to see other signs in the economy which are clearly signaling inflation is receding and it is time to ease up on tightening.

First off, it takes time to see the true impact of these rate hikes. Studies conducted by the Czech central bank concluded that the maximum impact of interest-rate hikes on inflation was two to four years in advanced economies. This is due to the time it takes in between raising rates, to weakening lending/investment, lowering consumer activity, increasing unemployment, and translating to lower inflation.

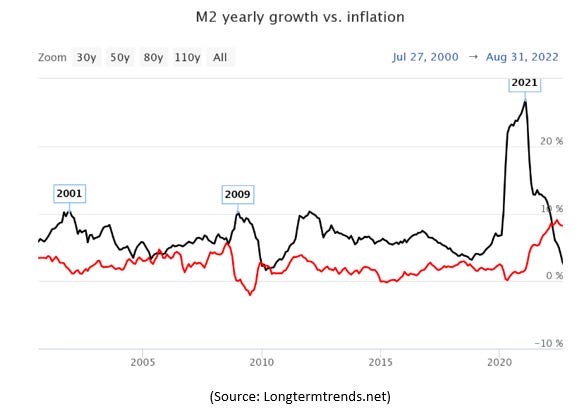

To predict inflation, instead of rates, look towards the growth in the M2 Money Supply (the measure of money supply that includes cash, checking deposits, and non-cash assets that can be easily converted into cash). M2 can be thought of as all the economy’s liquid assets. Using elementary-school logic, the more liquid assets you have in an economy, the larger inflation should grow.

In the chart below, growth of M2 (black line), skyrocketed during the pandemic as the Fed implemented Quantitative Easing in the form of stimulus checks which boosted liquidity in the markets (resulting in the COVID-rebound). While this saved the market in the short-term, this also inevitably resulted in sky-high inflation.

Since then, the Fed has corrected its mistake, dramatically slowing down the growth in M2 from its peak annual rate of 26.9% in early 2021 to just 2.6% as of September. Great job, Fed! As excess liquidity continues to tighten, lending will tighten as well and rates will naturally expand, leading to a gradual cooldown in the economy and declining inflation. The Fed just needs to let the economy run its course before they cause any more harm.

“I Am Not A Quitter” – Liz Truss

Summary:

The resignation of Liz Truss from the office of Prime Minister teaches shows how it is unreasonable for leaders to promise growth by more borrowing money when there is no clear way to repay it. This is especially the case when central banks worldwide are implementing Quantitative Tightening to combat red-hot inflation, sending interest rates skyrocketing.

Full Story:

An important lesson in financial responsibility came from the UK this week as Liz Truss (Prime Minister of the UK) stepped down from her position after spreading panic throughout the financial markets.

The new budget Truss proposed would expand government spending to lower the cost of living while also increasing tax cuts. This raised questions as to how the government would be expected to fund the increased spending. Keep in mind this plan for expanded government spending comes at a time where inflation in the U.K. has hit 10.1%. Investors would revolt drastically to the news:

“Along with approaching QT from the Bank of England, the budget spurred a liquidity crisis in the U.K. bond market. Chaos ensued with the effect on pension funds and the mortgage market forcing the BoE to step in and buy long-dated debt. The 30-year gilt yield even topped 5% and the pound approached parity with the greenback, touching $1.03.” (Seeking Alpha)

Even after replacing her finance minister, Kwasi Kwarteng, with Jeremy Hunt, and going back on all the promised tax cuts, the damage was done, and Truss announced her resignation. Replacing Truss is Rishi Sunak a former rival of Truss’ who was outwardly critical of her tax cuts and unfunded growth initiatives. It is expected that the U.K. Treasury will announce additional plans to cut back spending and raise taxes to address the $45B deficit the nation is currently experiencing.

The moral of the story: it is unreasonable for leaders to promise growth by more borrowing money when there is no clear way to repay it. This is especially the case when central banks worldwide are implementing Quantitative Tightening to combat red-hot inflation, sending interest rates skyrocketing.

China’s Economic Slowdown, Xi Is Not The Leader They Need

Summary:

The selloff seen in American-listed Chinese equities after Xi Jingping secured his third term signal the negative outlook investors have towards China. We expect to see continuation of the economically-restrictive “Zero-Covid” policies he has set in place, and a gradual centralization of the Chinese economy.

Full Story:

Xi Jingping recently secured his third term as leader of the Communist Party of China. In response, U.S.-listed Chinese stocks faced a massive selloff, losing billions of dollars in market value and declining to a decade-long low.

On the same day, the Nasdaq Golden Dragon China Index, which tracks dozens of Chinese companies listed on American exchanges, fell by over 14% to lows not seen since mid-2013.

Xi’s reappointment all but affirmed to investors the continuation of a firm zero-Covid policy stance which has clamped down on economic activity in China, and an iron-handed approach towards China’s most valuable companies. This is a leader who has stated again and again that “national security” comes before economic growth/stability.

In addition, it’s doubtful that Xi’s own policies have been effective in promoting economic growth for China as a whole. China’s most valuable enterprises such as Alibaba and Tencent were founded during periods of lax government oversight and a more capitalism-focused society long before Xi came into power.

While investment into China has remained at high levels, since Xi took office, GDP growth has slowed considerably. With Xi locked in for a third-term and a committee filled with loyalists, we expect to see future growth in China slow down further as its largest private companies become far more regulated and centralized under authoritarian rule.

That’s all for now! Thank you for reading and see you in the next issue!